ev tax credit 2022 texas

To receive the funds TxDOT submitted its Electric Vehicle Infrastructure Plan on July 28 2022 to the Joint Office describing how it will use its NEVI funds. Couples that earn less than 300000 a year and individuals who earn less than 150000 a year are eligible for these benefits.

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

It has already been passed by the Senate.

. Nissan e-NV200 electric car. The State of Texas offers a 2500 rebate for buying an electric car. The credit is for the purchase of a new plug-in electric vehicle with at least 5kw hours of capacity.

This incentive covers 30 of the cost with a maximum credit of up to 1000. 26 tax credit for equipment placed in service in 2033. The funds will be split 80 percent federal and 20 percent state.

The Inflation Reduction Act includes a new tax credit of up to 4000 on used electric vehicles. One goal of the new Inflation Reduction Act is to make electric cars more affordable thanks to tax credits. Federal Tax Credit 200000 vehicles per manufacturer.

The largest is the Light-Duty Alternative Fuel Vehicle Rebate which offers a credit of up to 2500 for buying an electric vehicle or plug in hybrid. The amount of the credit will vary depending on the capacity of the battery used to power the car. However the credit is worth up to 7500 depending on the size of the battery.

Heres Everything You Need To Know About the New Electric Vehicle Tax Credit The EV tax credit is set to change in a big way so lets run through the details. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. EV Tax Credit Expansion.

Various utility companies in the state offer rebates for Level 2 EV chargers with Austin Energy offering the most generous rebate of 50 up to 1200. August 20 2022 by Tom Harbid. To encourage the transition from gas-powered vehicles the IRA includes tax rebates for electric vehicles.

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. From 2023 a 1200 annual tax credit limit will replace the old 500 lifetime limit. However the requirements are now more challenging and the 7500 tax credit is split into two parts depending on the battery minerals and components.

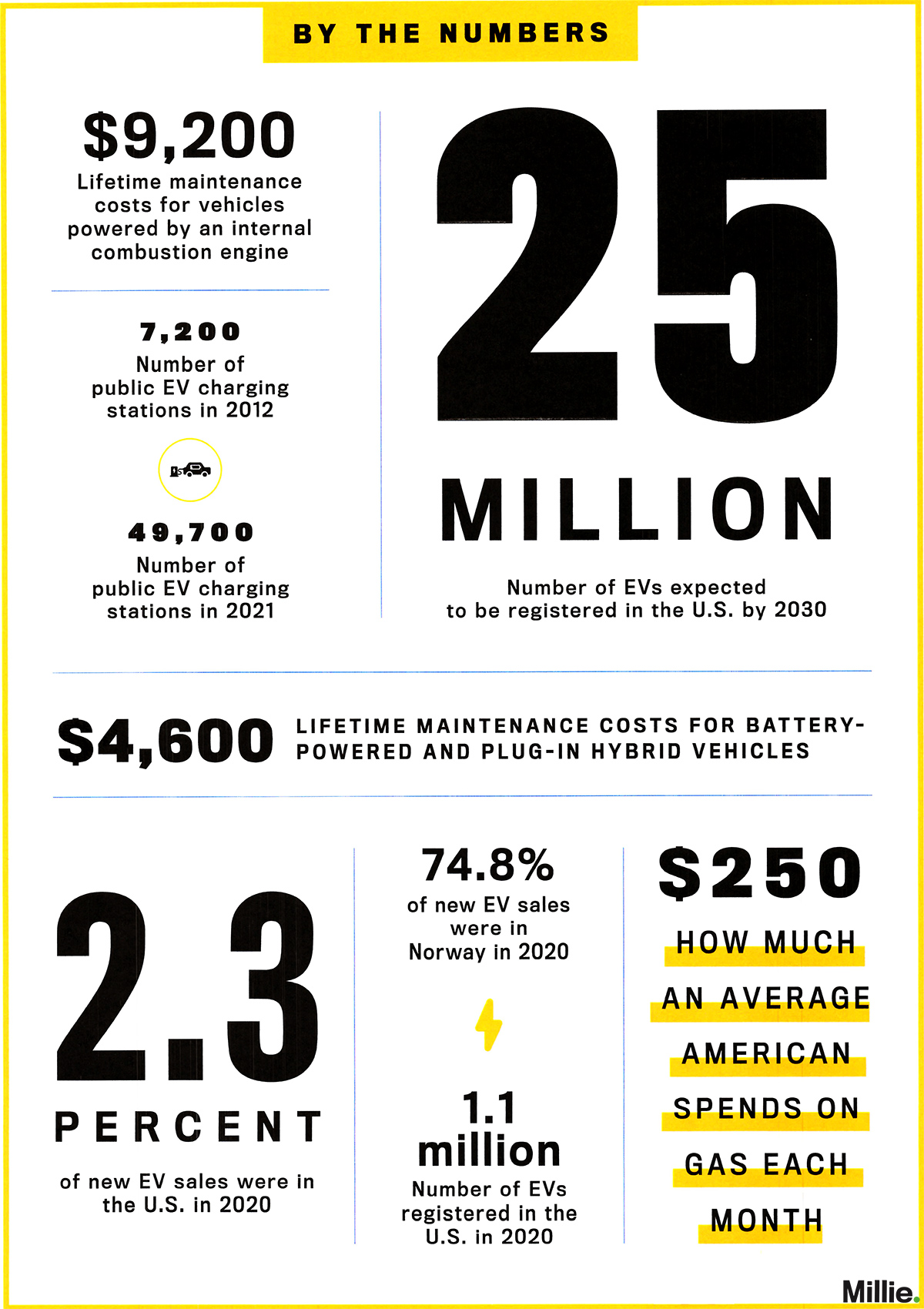

The value of the EV tax credit youre eligible for depends on the cars battery size. Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers.

Included in this is a tax credit for consumers to purchase electric vehicles. By Shelly Brisbin August 12 2022 1257 pm Government Politics Tech Innovation Texas Standard Original. 22 tax credit for equipment places in service in 2024.

A 7500 rebate on new EVs and a 4500 tax credit for used EVs. 250 rebate and a tax credit for 30 of installation costs. To qualify for the credit youll have to make an adjusted gross income of less than 150000 as a single person 225K for head of household and 300000K fo r joint filers.

The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits. The old 500 lifetime limitation still applies for the rest of 2022. The price for an average new electric vehicle is 66000 dollars according the Kelley Blue Book.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV credit for purchasing a new electric vehicle after August 16 2022 which is the date that the Inflation Reduction Act of 2022 was enacted a tax credit is generally available only for qualifying. If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16 2022 but do not take possession of the vehicle until on or after August 16 2022 for example because the vehicle has not been delivered you may claim the EV credit based on the rules that were in effect before August 16 2022. The US Federal tax credit is up to 7500 for an buying electric car.

How Much Is the EV Tax Credit Worth. The incentives had been proposed to go as high as 12500 on new cars and up to 4000 on used electric vehicles. 30 tax credit for equipment placed in service between 2022 and 2032.

The new car credit will offset up to 7500 of a new electric vehicles cost. The House is expected to pass it on Friday and then it will be sent to President Biden to be signed into law. Texas has a number of EV tax credits and incentives for electric vehicle EV owners.

Under The Inflation Reduction Act the Solar Investment Tax Credit looks like this. IRS Tax Credit for Plug-In Electric Vehicles - Up to 7500 The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

If you purchased a Nissan Leaf and your tax bill was 5000 that. For fiscal years 2022-2026 Texas will receive 4078 million. Among the provisions tucked into the Inflation Reduction Act that was recently passed by the Senate is a tax credit.

Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at least 2500. 50 of purchase and installation costs up to 500. August 11 2022.

The federal EV tax credit will change if the Inflation Reduction Act is signed into law. By Rob Stumpf Aug 15 2022 1234 PM. After the base 2500 the tax credit adds 417 for a 5.

Texas High School Tells Students to Use Sex Toys to Overcome Sexual Anxiety On Sunday the official. The 30 tax credit applies to any solar panel installation after January 1 2022. Roberto Wakerell-Cruz August 25 2022 NEWS ANALYSIS.

Texas EV Rebate Program 2000 applications accepted per year. State and municipal tax breaks may also be available. The federal government is offering select consumers up to 7500 in discounts to buy an electric car.

According to the Inflation Reduction Act more vehicles are now qualified for the new EV tax credit in 2022. Southwestern Electric Power Company.

2023 Chevy Bolt Ev Is Still The Best Value Ev In America By Far

How Much Is A Tesla Prices For Model 3 Model Y And More Electrek

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Could New Federal Ev Tax Credit Crater Ev Sales Until End Of The Year Electrek

How Much Is A Tesla Prices For Model 3 Model Y And More Electrek

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Ev Rebate Vs Tax Credit What S The Difference Between Ev Incentives

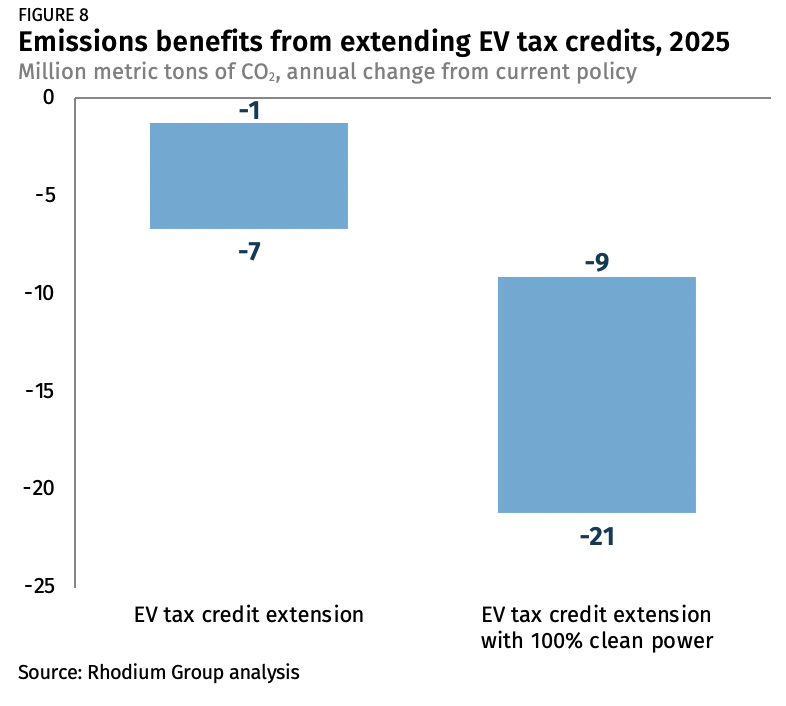

Can Tax Credits Tackle Climate Rhodium Group

How Much Is A Tesla Prices For Model 3 Model Y And More Electrek

Ev Charging Stations For Multifamily Buildings In Nyc

Ev Rebate Vs Tax Credit What S The Difference Between Ev Incentives

Proposed Tax Break For Buying Electric Vehicles Is Too Hard To Get Auto Makers Say Wsj

Gm Ford Are All In On Evs Here S How Dealers Feel About It

Wind Turbines In Texas Faqs Facts And Figures

Ev Rebate Vs Tax Credit What S The Difference Between Ev Incentives

Can You Buy An Electric Car In Texas Jerry

The Cheapest Electric Cars In 2022 U S News

Proposed Tax Break For Buying Electric Vehicles Is Too Hard To Get Auto Makers Say Wsj